Maybe it’s just the barking, old man in me (wary of hype and suspicious of structures built on sand); perhaps even traces of envy, maybe because I don’t use it, or I just don’t like how the Founder, in my opinion, tries too hard to be eccentric. I don’t know, but from a professional and personal perspective, Groupon just rubs me the wrong way — a cutthroat business in Chuck Taylors.

There’s three other reasons:

- Too much, too soon: a company growing quickly but losing money:

Groupon spends a lot of money to attract and retain customers. During the first quarter of this year, it spent $208 million for marketing, up from $4 million in the same period a year earlier. Not surprisingly, the company lost $102.7 million the following quarter, more than twice the amount they lost the previous year.

It’s like starting your real estate brokerage by attracting the top ten agents in your city with a $100,000 signing bonus and leasing 5 billboards on your major freeway.

“The filing also discloses that the company spent $203.2 million in acquisitions last year, having struck 13 takeovers since May of last year.”

I’m wary of businesses that build momentum and marketshare using brute force, especially if it’s financed by other people’s cash — it’s not hard to bet on a horse using your allowance money.

Vanity Fair described it as ”cognitive dissonance”:

SPHERE OF INFLUENCE: Groupon’s model of offering coupons for local businesses may not sound particularly sexy, but revenues grew by more than 2,000 percent in 2010, a figure that blows away early growth rates at Google, Amazon, and possibly every major company in history.

MOMENT OF COGNITIVE DISSONANCE: Groupon’s I.P.O. filing with the S.E.C. showed that it had a massive net loss of almost $400 million last year. The day after the filing, Groupon’s largest shareholder, Eric Lefkofsky, told Bloomberg News that “Groupon is going to be wildly profitable”—a violation of S.E.C. rules that has triggered a potential delay in the I.P.O.

- Questionable Business Ethics:

In every remarkable idea or innovation you can expect a fair share of haters. Anytime I witness a major success story there seems to be, like clock-work, a small mob of incurable naysayers throwing tomatoes. This is just the world we live in.

But with Groupon, the negative barrage outnumbers the good things said about the company. I’m sure there are hundreds, if not thousands of happy customers and merchants, but it seems like every time I read something about the company it’s either being torched by respected news agencies or being given not-so-nice reviews by business owners.

There are naysayers, and there is, as my Grandma puts it: “When there’s smoke, there is fire.” So I decided to do my own research.

Five words: Adjustable Consolidated Segment Operating Income.

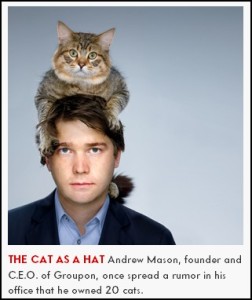

“We spend a lot of money acquiring new subscribers because we can measure the return and believe in the long-term value of the marketplace we’re creating,” Andrew D. Mason, the company’s chief executive, wrote in a letter to potential shareholders.” – Andrew Mason, CEO

CSOI in plain language:

Going by the nonstandard metric, Groupon pulled in nearly $60.6 million last year, much higher than the $3.5 million it reported in 2009. And in the first quarter this year alone, the company reported $81.6 million in adjusted CSOI.

Groupon writes in its filing that it believes that the metric measures its financial health, excluding future operating expenses and noncash charges.

But those are very real costs, notably its huge marketing budget. The company spent $263.2 million in marketing last year, an astronomical leap over the $4.5 million it reported for 2009.

Not even Wall Street, with all it’s well documented monkey schemes, buys this metric. And that’s not good. A part of me also asks, why do even have to go public with a goal of raising $750,000,000 with all these private investor millions feeding you since birth?

I also don’t like the fact that it took them (still?) 60 days to pay some merchants:

“Another concerning part of their current liabilities is that $290 million of it is “accrued merchant payables” — in the US they take up to 60 days to repay merchants. So that $290 million is merchants who have rendered services waiting to get repaid by Groupon. Not exactly the best merchant experience.”

I used to have restaurant and I can tell you the meat and vegetable guy knocks on the door every 30’th of the month.

- I don’t trust their primary market — Penny Pinchers!

(…And that’s when I lost them all)….Let me say this: I like great deals and I am a fourth generation bargain hunter. Like many of you, I am a value buyer. I’m not talking about people who likes to maximize the bang for their buck.

When I refer to P.P’s, I’m talking about those people who ask for your pants after giving them the shirt off your back. Realtors, yes I’m talking to you, you know these type of people like you know your Mother’s eyes — buyers who think of us as fancy cab rides, showing twenty homes and without a trace of conscience, makes an offer on a deal without your name on it.

You might counter: “Joe, What makes you so sure these are the majority of Groupon’s Customers?”

I’m not.

But I do know that their business model, however clever and useful, doesn’t exactly create Harley-Davidson—Zappos—Threadless—L.L Bean—Deadheads–type of hard core loyalty. Why would it? It’s so easy to recreate and so far, I can’t see no real sentimental value in using Groupon. Not to mention, Living Social is on the rise.

Assuming my hunch is right, P.P’s is a flimsy market to depend your business on. Heavy discounts for many is like a drug, searching for the next best deal to satisfy their insatiable, find the cheapest, deal-hunger …

The scary part is the CEO is betting big that they will come back:

“We spend a lot of money acquiring new subscribers because we can measure the return and believe in the long-term value of the marketplace we’re creating,” Andrew D. Mason, the company’s chief executive, wrote in a letter to potential shareholders.

Furthermore, the company says that once it has subscribers, it costs relatively little to maintain them, since Groupon’s interaction with them is mostly through daily e-mails and mobile applications. By locking up those subscribers, the company is betting that they’ll stick with the service and continue to buy up daily offerings.

..Groupon clearly views signing up as many available consumers as possible to lock them up is worth its sky-high marketing costs.”

This post is not meant to step on Groupon, it’s just not cool to wait for someone’s demise. (They employ close to 5,000 to people.) But I want to challenge Groupon to go back to the drawing board and honestly access your business — consult your Grandpas, Kiddos — there’s a lot you can learn from the Old School.

There’s just too much at stake. Believe it or not, deep inside, I’m rooting for your success. I hope it’s not too late.

(And don’t forget to pay your Moms and Pops within thirty days, dammit.)

*You can follow me on Twitter =)

- The Secret to Converting a Surfer to Client - April 23, 2013

- My Open Letter to a President Goes Viral (well, sort of) - December 26, 2012

- 5-Year Question Every Online Marketer Needs to Ask - May 9, 2012